3 Keys to Deciding if you Should Buy or Rent

All over the news and social media we’re hearing the term “housing affordability crisis.” People are discussing the still rising costs of buying a new home, and, as a natural byproduct, the idea of renting instead.

In the ever-evolving landscape of real estate, the decision to buy or rent a home requires careful consideration. There are so many things that go into the choice. Fluctuating interest rates, your long-term goals and financial stability, and of course the housing market in general are all factors we need to think about.

Today, our goal is to break down three defining keys to deciding if you should buy or rent.

1. Market conditions

You might have a lot of questions when it comes to buying or renting — like what does the market even look like right now? Since interest rates are so high, should you rent before buying?

Interest rates play a crucial role in shaping how affordable a home is. As an example, high interest rates can lead potential homebuyers to think twice about purchasing property considering it raises monthly payments. Of course, there’s more to the story than just interest rates. It's important to take a look at the broader market dynamics.

For starters, we’re currently seeing fewer homes on the market. Fewer available homes can prevent you from finding exactly what you’re looking for long term. However, if you do find what you want, the scarcity of homes doesn’t have to be a bad thing. Because of the current interest rates, there’s actually less competition amongst buyers. This means that while your monthly payments may be higher, the actual price for the home may be lower than what it could when lower interest rates come along!

The current market conditions actually present a unique opportunity for home buying as long as you’re willing to explore your options and find what you want. Let’s not forget - you also have the option of refinancing your interest rates when they drop in the future, but your dream home may not be on the market that long.

It’s a delicate balancing act that requires us to look at our next key.

2. Long-term goals and flexibility

When choosing between renting and buying, don’t neglect your long-term goals and how they might alter your life. We discussed the idea of the perfect home in the last section. What exactly does that look like to you?

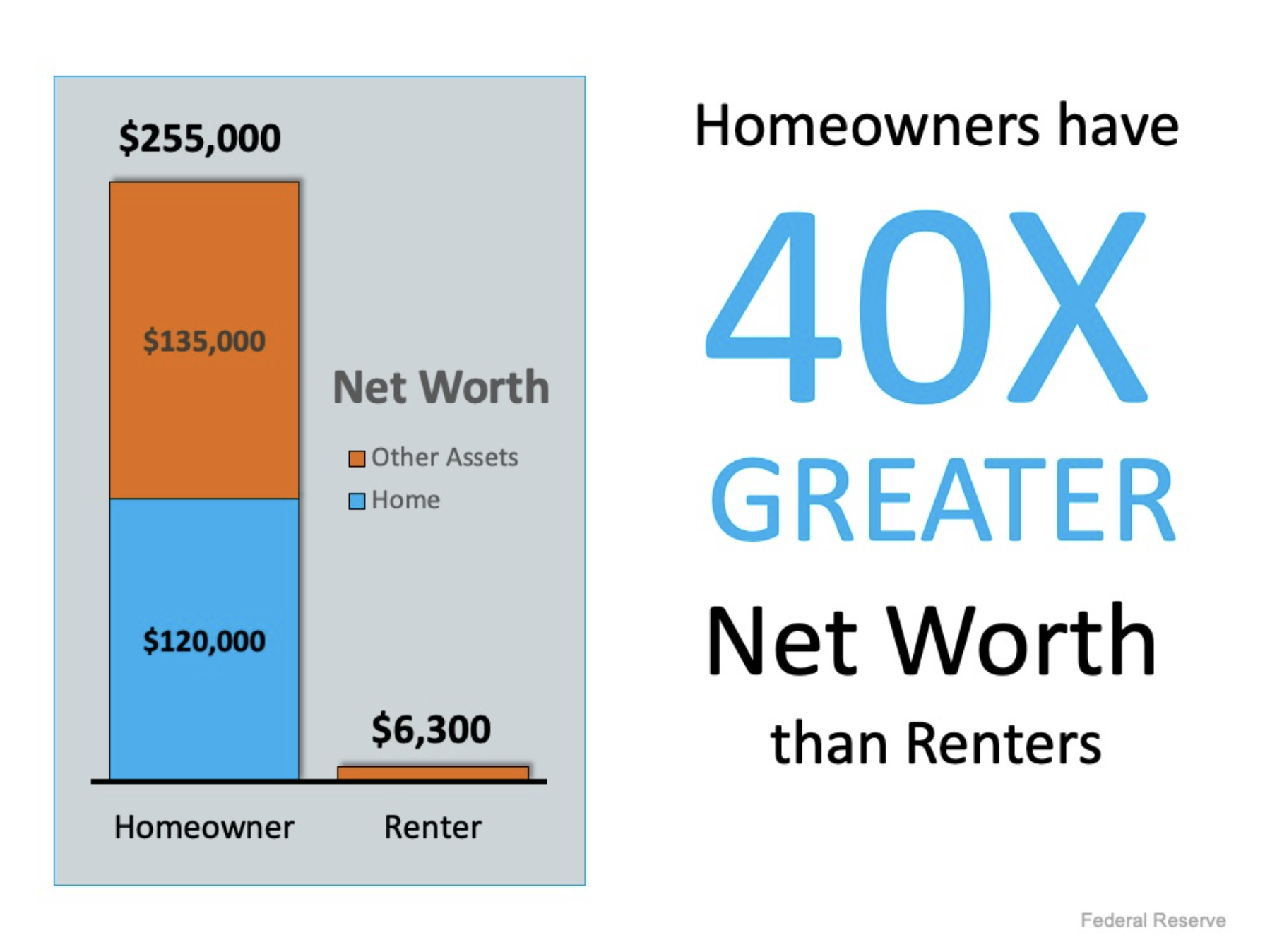

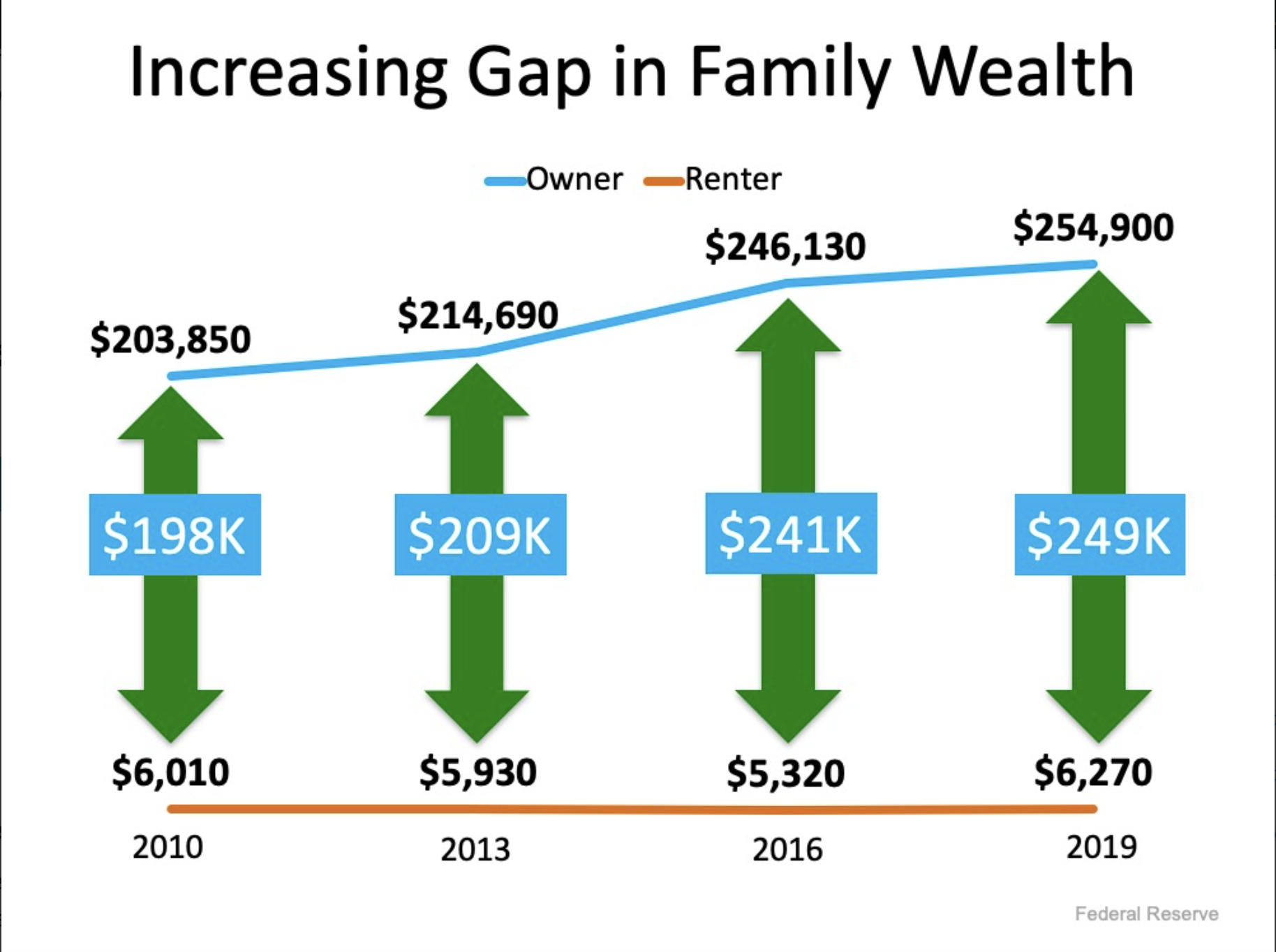

If you’re planning to stay in a particular area for a long time, building equity through homeownership is a smart way to go. Owning a home allows you to invest in an asset that can appreciate over time. It provides a stable foundation for your financial future. If your future location is more unstable, renting may be a better option for you. You can avoid larger market swings and be certain of your ability to get out when you need to.

If you’re expecting shifts in your career or family life, you’ll want to consider how those fit into your goals. With plans for a large family, settling down in a two-bedroom home might not be your best route. The flexibility of renting could be a better option for you if your life is characterized by potential changes. That gives you the opportunity to test the waters before committing to anything.

Once you understand the market conditions and align on your long term goals, it’s best to look at our final key - finances!

3. Your financial position

Finally, you’ll want to take inventory of your current financial situation. Be honest with yourself and assess where you’re at. It’s not worth trying to stretch your finances to the breaking point.

No doubt, you already know that buying a home comes with a substantial down payment. And if you’ve been considering a home purchase, you may already have enough saved for that initial lump sum. But it’s just as important to gauge your ability to continue making payments with a comfortable financial cushion. At Fine Point Homes, we recommend all our real estate clients have roughly 6 months of emergency spend in their bank account at all times to help them avoid any stress. Your peace of mind is just as important as enjoying your new home!

If the combination of a large down payment and high monthly payments is too much for comfort for now, renting could be the way to go. If, on the other hand, you can afford the outgoing money for now, buying a home (and refinancing later on) could be the perfect way to find your ideal home with less competition.

The decision to buy or rent is multi-faceted and requires a lot of thought. It’s always a good idea to consult a professional who can walk you through the most important elements of your situation and help you arrive at the best solution for you.

Our team has years of experience walking clients through not only this decision, but the entire process. We’d love to chat with you if finding that right home is on your mind!

Fine Point Homes believes in cutting through the confusion around your perfect home - whether that’s buying new or upgrading your existing house. We simplify the process and stay in touch during every aspect so that you always know what comes next.

If you’re interested in setting up an interview with our real estate team, contact us here.